Overpricing and stake size: On the robustness of results from experimental asset markets

Abstract

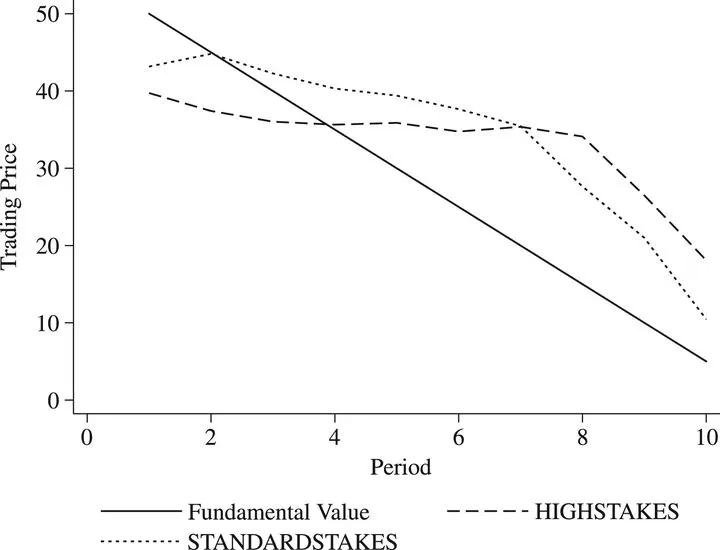

We assess the effects of a stake size variation on experimental asset markets. Our results show that a fivefold increase in stake size leads to higher trading frequencies. Mispricing and overpricing, however, are not fundamentally different for different stake sizes.