Unleashing animal spirits: Self-control and overpricing in experimental asset markets

Jun 1, 2019·,,·

1 min read

Martin G Kocher

Konstantin E Lucks

David Schindler

Abstract

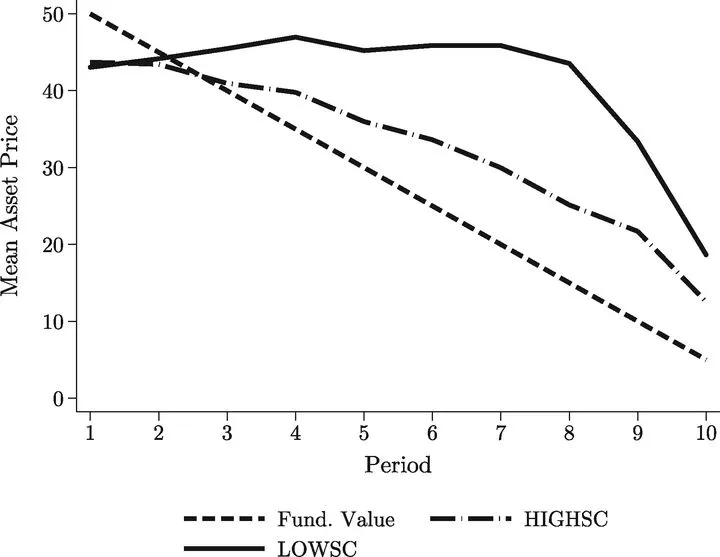

One explanation for overpricing on asset markets is a lack of traders’ self-control. We implement the first experiment to address the causal relationship between self-control and systematic overpricing on financial markets. Our setup detects some of the channels through which low individual self-control could transmit into irrational exuberance in markets. Our data indicate a large direct effect of reduced self-control on market overpricing. Low self-control traders report stronger emotions after the market.

Replication

Note: A recent study has failed to replicate our findings. Please contextualize our results accordingly and if you cite our paper, cite the replication efforts as well.